The AI Bubble: Who’s Cashing In, and Who Might Get Crushed

`Artificial intelligence is soaring like never before, with investors pouring record sums into startups promising to transform every sector imaginable. But behind the glittering surface of breakthrough demos and blockbuster valuations, a darker truth emerges: the AI market is precariously perched atop a speculative bubble that threatens widespread fallout.

The Record-Breaking Funding Frenzy

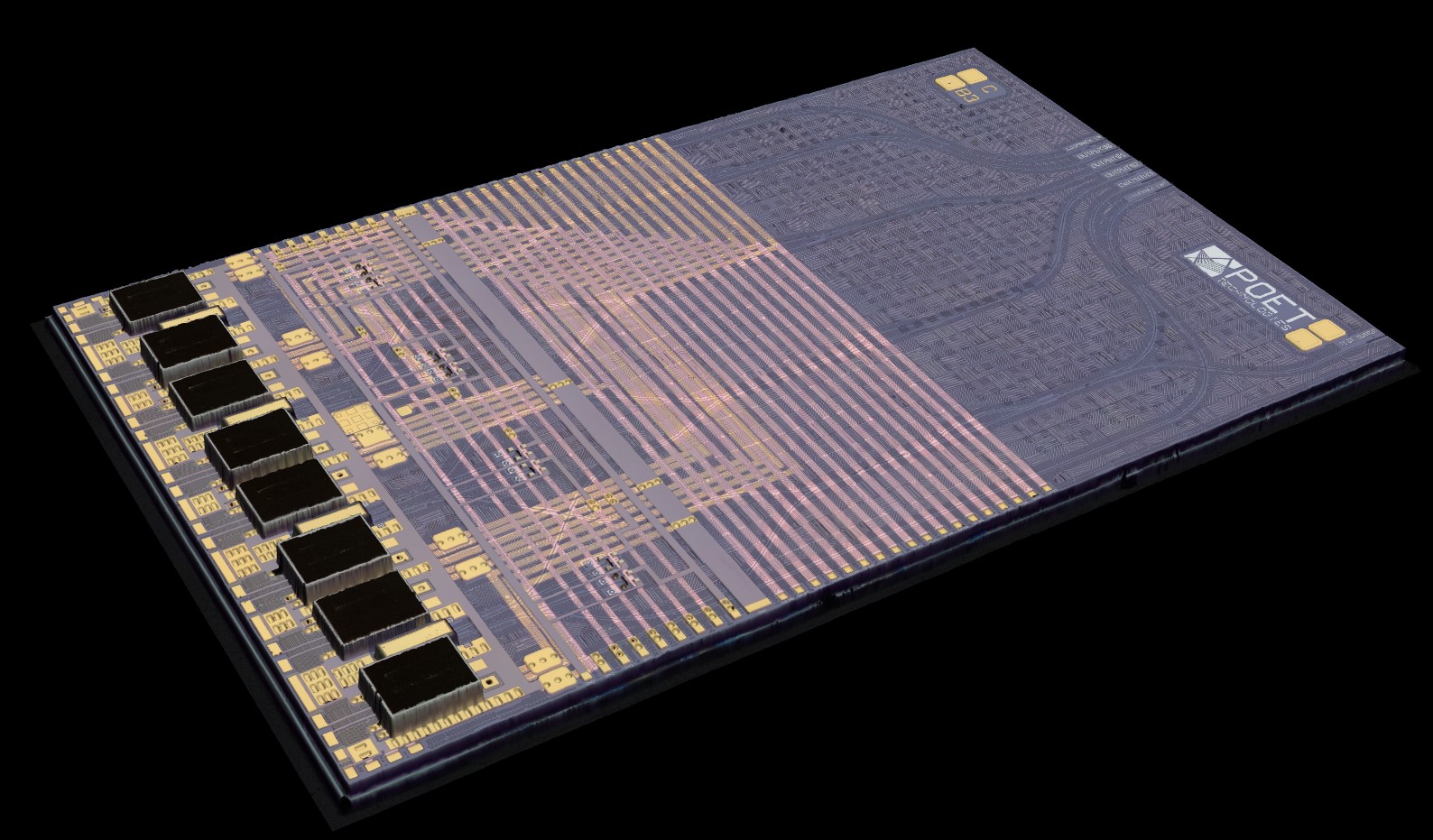

In just the first six months of 2025, AI startups in the U.S. raised an eye-watering $104 billion. This staggering influx of capital reflects not only a profound belief in AI’s transformative power but also a surge of investor fear of missing out (FOMO). Industry giants such as OpenAI now boast valuations hovering near half a trillion dollars, making AI one of the hottest—and most hyped—technologies in history.

Yet the amount being spent belies a troubling gap between investment and returns. Despite nearly $40 billion pumped annually into generative AI technologies, studies report that 95% of enterprises have yet to see meaningful returns on their AI investments. Many startups struggle with revenue growth and customer retention, a disconnect that hints at overheated expectations.

Voices Warning of Overexuberance

Sam Altman, CEO of OpenAI, candidly acknowledges the overstretched fervor gripping investors: “The investor excitement is far, far ahead of the reality of where this stuff is right now”. His admission echoes a growing chorus of skepticism.

Jeff Bezos, observing this frenzy through the lens of seasoned experience, calls it “massive over-investment fueled by hype,” warning it mirrors the infamous dot-com bubble of the late 1990s. Ray Dalio from Bridgewater Associates, a voice with a strong track record predicting market shifts, describes AI funding as “very similar” to past bubbles, citing negative cash flows and sky-high price-to-sales ratios as clear warning signs.

The Risks: Economic Reverberations and Market Panic

The AI bubble’s popping could unleash havoc far beyond tech stocks. Approximately 4% of recent U.S. GDP growth is tied to AI-related spending. If valuations crash and investors rush for exits, the shockwaves could cascade through venture capital, global tech employment, and innovation pipelines.

Market analysts point out that many “AI-first” companies operate at unsustainably high cash burn rates with unproven business models. Even AI giants rely heavily on marketing hype to mask steep operational costs. As costs for training massive language models soar, the challenge of turning AI innovation into profitability remains daunting.

When Reality Sets In

History offers caution: bubbles burst when hype decouples from deliverables. Regulatory risks, ethical controversies around AI bias, and technical barriers further complicate the picture. A sudden cooling of enthusiasm could provoke plummeting valuations, startup failures, and layoffs as capital dries up.

Yet, as with prior technological bubbles, there is hope. The post-dot-com era spins out valuable infrastructure and solid companies. The AI bubble may leave behind new tools, datasets, and techniques that persist well beyond the turbulence.

Navigating the AI boom demands a hard look at what’s real versus what’s speculative. Savvy investors, leaders, and policymakers must prioritize sustainable business models, measurable returns, and regulatory frameworks over viral demos and hype cycles.

The AI bubble shines a harsh light on our collective appetite for disruption—and the need for grounded, disciplined stewardship if AI’s promise is to survive beyond the bubble.